One of the more popular forms of sports gambling is betting against the spread. Before you place your bet, it is important to understand the way a point distribution works.

The point spread is a number set by the oddsmakers at a sportsbook that's designed to even out the playing field between two teams. It is a very popular way to bet a game and it can give you a better chance of winning.

Spread Meaning

You can use a point-spread to increase the profitability of your football bets. Unlike moneyline wagers, which are primarily used in baseball and hockey games, point spread bets are popular across all major sports.

A bet against the spread is a way to bet on a team that you believe isn't as good as its record suggests. This can be an excellent way to increase your winnings, but you must do the research to make sure that you are making the correct picks.

How does the point spread work exactly?

In a football game, the point spread is the difference in the total number of points that will be scored by the two teams. In determining the point spread, oddsmakers take into account a wide range of factors. They consider recent form, previous results and key injuries.

Spread betting: What you need to know

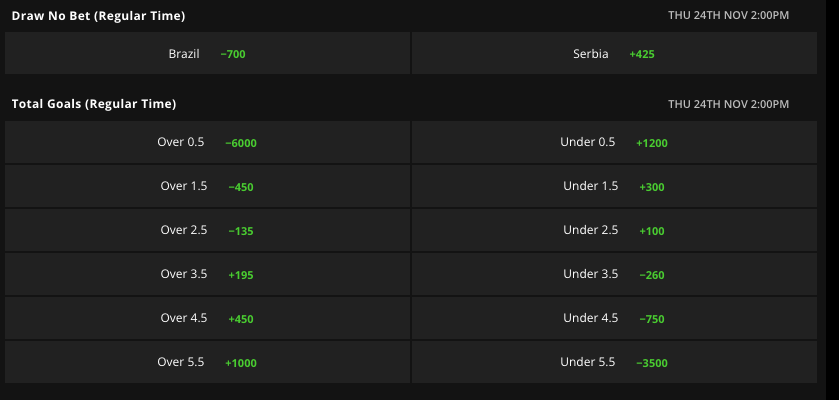

You can bet on sports whether you're a beginner or an expert. Your favorite sportsbook has a point spread that is available for each match. These odds will include the favored team and the underdog team. The favored team will have a minus sign next to the odds and the underdog will have a plus sign. This tool is very helpful for new bettors because it helps them determine the team that will win the match by a greater margin than the point difference.

Spread Betting: How to place a spread bet

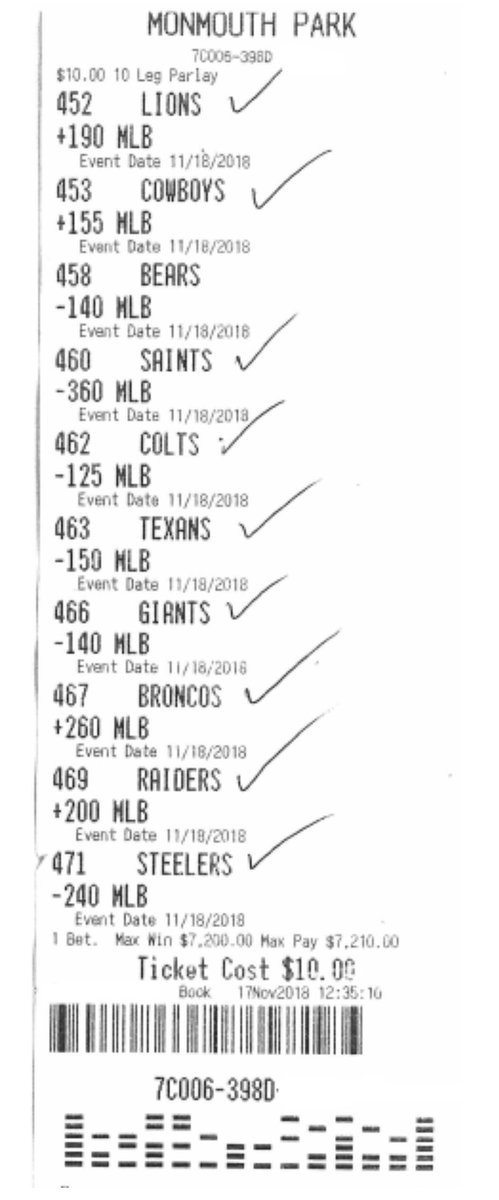

The oddsmakers at your favorite online sportsbook will also offer the option to place bets on the spread. These bets will require you to make multiple predictions in order to win. This is a lengthy and difficult process, but if you really want to win money it's well worth the effort.

How to Pick a Winning Bet Spread

You'll need to know the favored team's record and how it compares with the underdog's. It's important to also consider the overall record of the team, both at home and abroad, as you do their conference record. This information will allow you to make the most informed bets possible.

How to Read Spreads Summary: If you are betting on a spread, be sure to check all the numbers. You should always make sure that you keep your spread within three or seven key numbers. These numbers are usually the most common margins for victory in football, and will determine which side you should bet.

FAQ

How do wealthy people earn passive income through investing?

There are two ways you can make money online. Another way is to make great products (or service) that people love. This is what we call "earning money".

You can also find ways to add value to others, without having to spend your time creating products. This is what we call "passive" or passive income.

Let's imagine you own an App Company. Your job is developing apps. But instead of selling them directly to users, you decide to give them away for free. This business model is great because it does not depend on paying users. Instead, advertising revenue is your only source of income.

To help you pay your bills while you build your business, you may also be able to charge customers monthly.

This is how most successful internet entrepreneurs earn money today. Instead of making money, they are focused on providing value to others.

What is the limit of debt?

It is important to remember that too much money can be dangerous. Spending more than you earn will eventually lead to cash shortages. Savings take time to grow. If you are running out of funds, cut back on your spending.

But how much can you afford? There's no right or wrong number, but it is recommended that you live within 10% of your income. This will ensure that you don't go bankrupt even after years of saving.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. If you make $20,000, you should' t spend more than $2,000 per month. And if you make $50,000, you shouldn't spend more than $5,000 per month.

It's important to pay off any debts as soon and as quickly as you can. This includes student loans, credit cards, car payments, and student loans. Once those are paid off, you'll have extra money left over to save.

You should also consider whether you would like to invest any surplus income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. However, if you put your money into a savings account you can expect to see interest compound over time.

Let's take, for example, $100 per week that you have set aside to save. That would amount to $500 over five years. You'd have $1,000 saved by the end of six year. In eight years, you'd have nearly $3,000 in the bank. It would take you close to $13,000 to save by the time that you reach ten.

After fifteen years, your savings account will have $40,000 left. Now that's quite impressive. But if you had put the same amount into the stock market over the same time period, you would have earned interest. You'd have more than $57,000 instead of $40,000

It's crucial to learn how you can manage your finances effectively. A poor financial management system can lead to you spending more than you intended.

What is the difference between passive and active income?

Passive income can be defined as a way to make passive income without any work. Active income is earned through hard work and effort.

When you make value for others, that is called active income. If you provide a service or product that someone is interested in, you can earn money. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income is great because you can focus on other important things while still earning money. Most people aren’t keen to work for themselves. They choose to make passive income and invest their time and energy.

Problem is, passive income won't last forever. If you are not quick enough to start generating passive income you could run out.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, You should start immediately. If you wait to start earning passive income, you might miss out opportunities to maximize the potential of your earnings.

There are three types or passive income streams.

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

Investments include stocks, bonds, mutual funds, ETFs, and ETFs.

-

Real Estate includes flipping houses, purchasing land and renting properties.

How to build a passive stream of income?

To make consistent earnings from one source you must first understand why people purchase what they do.

It means listening to their needs and desires. It is important to learn how to communicate with people and to sell to them.

The next step is how to convert leads and sales. The final step is to master customer service in order to keep happy clients.

You may not realize this, but every product or service has a buyer. You can even design your entire business around that buyer if you know what they are.

It takes a lot of work to become a millionaire. A billionaire requires even more work. Why? It is because you have to first become a 1,000aire before you can become a millionaire.

You can then become a millionaire. And finally, you have to become a billionaire. The same goes for becoming a billionaire.

How does one become billionaire? Well, it starts with being a thousandaire. All you have do is earn money to get there.

You must first get started before you can make money. Let's take a look at how we can get started.

How can a novice earn passive income as a contractor?

Learn the basics and how to create value yourself. Then, find ways to make money with that value.

You may have some ideas. If you do, great! You're great!

Online earning money is easy if you are looking for opportunities that match your interests and skills.

For instance, if you enjoy creating websites or apps, there are lots of ways that you can generate revenue even while you sleep.

You might also enjoy reviewing products if you are more interested writing. Or if you're creative, you might consider designing logos or artwork for clients.

No matter what focus you choose, be sure to find something you like. It will be a long-lasting commitment.

Once you have discovered a product or service that you are passionate about helping others purchase, you need to figure how to market it.

There are two main ways to go about this. The first is to charge a flat-rate for your services (like freelancers) and the second is per project (like agencies).

You'll need promotion for your rates in either case. This can be done via social media, emailing, flyers, or posting them to your list.

These are three ways to improve your chances of success in marketing your business.

-

Market like a professional: Always act professional when you do anything in marketing. It is impossible to predict who might be reading your content.

-

Know what your topic is before you discuss it. Fake experts are not appreciated.

-

Don't spam - avoid emailing everyone in your address book unless they specifically asked for information. You can send a recommendation to someone who has asked for it.

-

Use a good email provider - Gmail and Yahoo Mail are both free and easy to use.

-

Monitor your results - track how many people open your messages, click links, and sign up for your mailing lists.

-

How to measure ROI: Measure the number and conversions generated by each campaign.

-

Ask your family and friends for feedback.

-

To find out which strategy works best, you can test different strategies.

-

Learn new things - Keep learning to be a marketer.

What is personal financial planning?

Personal finance refers to managing your finances in order to achieve your personal and professional goals. This involves knowing where your money is going, what you can afford, as well as balancing your wants and needs.

Learning these skills will make you financially independent. You won't need to rely on anyone else for your needs. You're free from worrying about paying rent, utilities, and other bills every month.

Not only will it help you to get ahead, but also how to manage your money. It can make you happier. Feeling good about your finances will make you happier, more productive, and allow you to enjoy your life more.

So who cares about personal finance? Everyone does! The most searched topic on the Internet is personal finance. According to Google Trends, searches for "personal finance" increased by 1,600% between 2004 and 2014.

People use their smartphones today to manage their finances, compare prices and build wealth. These people read blogs like this one and watch YouTube videos about personal finance. They also listen to podcasts on investing.

According to Bankrate.com Americans spend on average four hours per day watching TV, listening and playing music, browsing the Internet, reading books, and talking to friends. It leaves just two hours each day to do everything else important.

You'll be able take advantage of your time when you understand personal finance.

Statistics

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

External Links

How To

How to make money at home

There's always room to improve, no matter how much you make online. But even the most successful entrepreneurs struggle to grow their businesses and increase profits.

The problem with starting a business is that it's easy for you to get stuck in a routine and not focus on your goals. This could mean that you spend more time marketing than product development. Or you may neglect customer service altogether.

It's important to regularly evaluate your progress and determine if you're improving or maintaining the status-quo. These are five ways to increase your income.

Productivity is not just about output. It's also about being able to do tasks well. Find out what parts of your job take the most effort and are energy-consuming, and then delegate these tasks to another person.

For example, if you're an eCommerce entrepreneur, you could hire virtual assistants to handle social media, email management, and customer support.

You could also assign a team member to create blog posts and another to manage your lead-generation campaigns. If you are delegating, make sure to choose people who will help your achieve your goals more quickly and better.

-

Marketing is not the most important thing.

Marketing doesn't necessarily mean spending lots of money. Some of the best marketers aren't paid employees at all. They are consultants who work for themselves and earn commissions based upon the value of their services.

Instead of advertising your products via print ads and radio, or TV, consider joining affiliate programs. These programs allow you to promote other businesses' products and services. You don't have to buy the expensive inventory to generate sales.

-

Hiring an Expert to Do What you Can't

You can also hire freelancers for expertise in specific areas. For example, if you're unfamiliar with graphic design, you could hire a freelance designer to develop graphics for your site.

-

Get Paid Faster By Using Invoice Apps

Invoicing can be tedious when you work as an independent contractor. Invoicing is especially time-consuming when multiple clients want the same thing.

Apps such as Xero, FreshBooks, and FreshBooks let you invoice customers quickly and efficiently. It's easy to input all of your client details once you have the app and send them invoices.

-

Increase Product Sales with Affiliate Programs

Affiliate programs are great because they let you sell products without needing to stock inventory. It's also easy to ship products. To create a link to your vendor's website, all you have to do is setup a URL. Then, you receive a commission whenever someone buys something from the vendor. Affiliate programs will help you to make more money and build a brand. Your audience will eventually find you if you offer quality content and services.